Demand from new buyers in Northern Ireland’s housing market rose at the fastest rate in nearly three years according to the latest RICS and Ulster Bank Residential Market Survey. It comes at a time when supply levels also continued to edge upwards.

A net balance of 53% of Northern Ireland respondents reported that new buyer enquiries rose through the month of August. This is up from 38% in July, and the highest balance seen since November 2021.

On the supply front, a net balance of 54% of NI respondents reported that supply levels rose through August, the highest balance seen since the pandemic.

It is unsurprising therefore that Northern Ireland surveyors noted a rise in sales in the most recent survey. A net balance of 38% of respondents reported that newly agreed sales increased through August.

Respondents also anticipate that the upward trajectory on the sales front will continue in the short-term, with a net balance of 49% anticipating that sales will rise over the next three months.

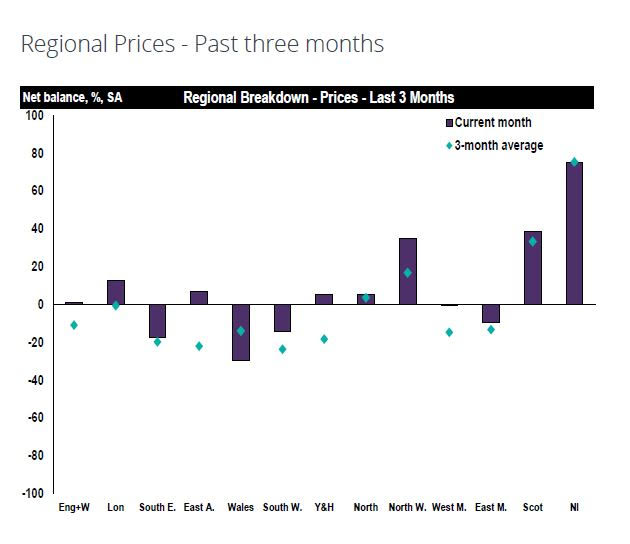

Looking at pricing, a net balance of 75% of surveyors in NI reported that prices have risen over the past three months. Once again, NI continues to outperform other UK regions, and is well above the average UK price balance which is reported to have fallen flat through August.

Surveyors remain positive on the pricing front looking forward as a net balance of 45% of surveyors anticipate that prices will rise over the next three months. However, this is lower than has been seen in previous months; down from 70% in July and 68% in June.

Samuel Dickey, RICS Northern Ireland Residential Property Spokesman, comments, “Interest rate cuts are boosting confidence but the most significant factor impacting on the market continues to be the fact that demand is outstripping supply. This is a longstanding challenge, and whilst an increase in supply to the market was reported in August, we are also seeing demand increasing. This explains the ongoing upward pressure on prices. This is also a dynamic evident in the rental market. Anecdotal evidence points the rental market continuing to face the same pressures on the supply front, which is pushing up rents.”

Stephen Lavery, Local Director, Ulster Bank said, “The findings of this month’s survey very much tally with our own experiences as the number of mortgage enquiries we are dealing with continues to rise. It is welcome that the latest survey reported a rise in supply as this was one of the biggest challenges facing potential buyers. Overall, the survey paints a largely positive picture of the local housing market and it is evident that recent cuts to interest rates are continuing to provide a boost to confidence and optimism levels.”